Build and monetize a first class marketplace experience for autos buyers and sellers.

Shopping for a car is a long and complicated journey. Buyers are confronted with many difficult questions: Should I buy new or used? Is this the right price? Will the car be reliable in the future? Can I trust the seller?

Likewise, car sellers have their own set of problems. Will I get the maximum value for my car? What information do I include on the listing? When is the soonest I can sell it?

Both come to OfferUp, a local buy and sell marketplace, to achieve their goals. In fact, Autos is one of the highest grossing and most engaged categories on OfferUp. The company estimates that 10% of all used car sales in the U.S. happen on OfferUp.

To better capitalize on the activity in this category, my product partner and I did some early research and discovered:

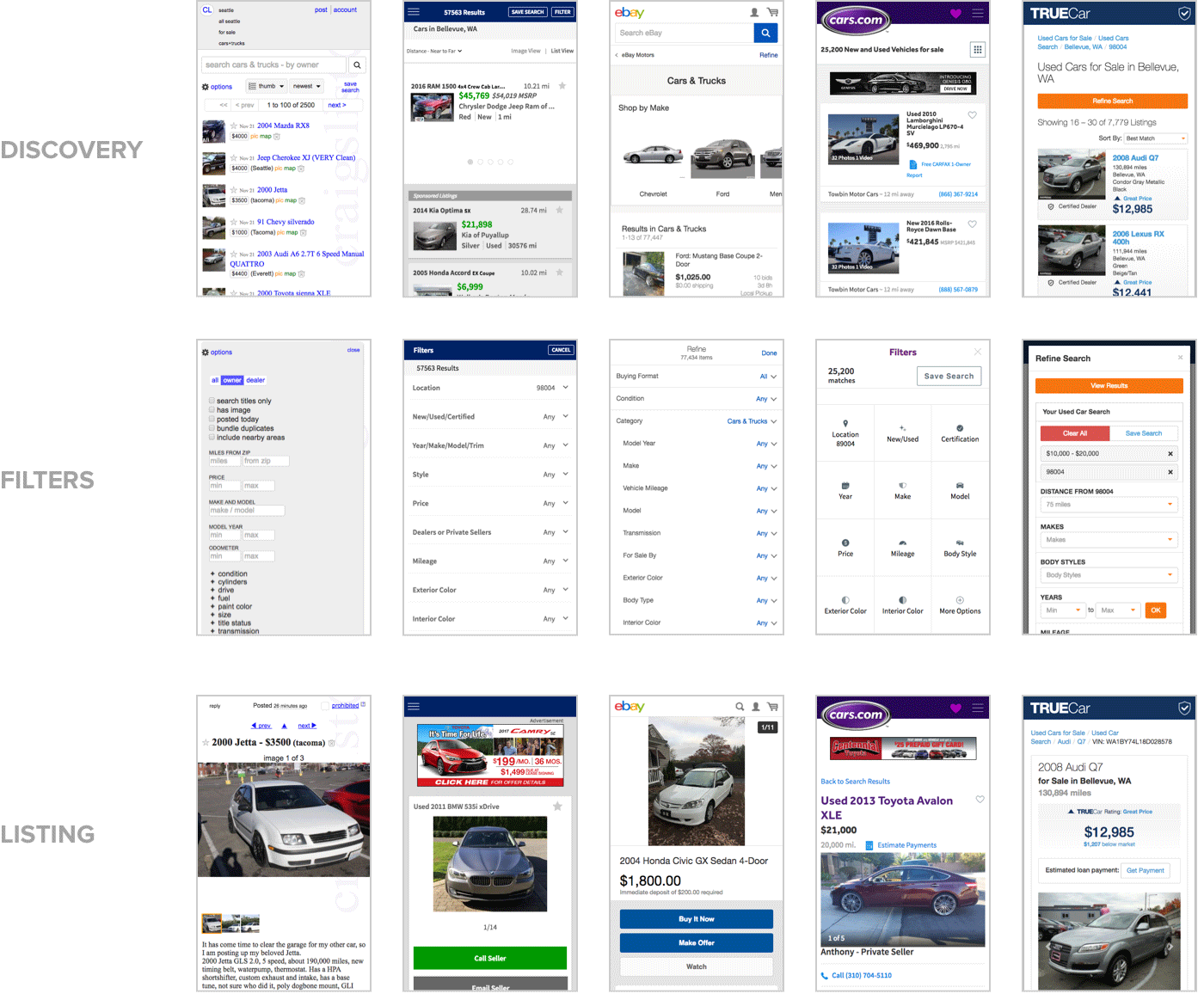

- The car shopping experience was generic and feature poor. The autos category was presented the same as baby clothes or garden tools.

- The car selling flow lacked key car data inputs, leading to a lot of variance in listing quality.

- Many dealers were attracted to the high traffic of the marketplace and posed as private sellers to sell their inventory.

Our primary goal was to continue to grow traffic by building an enhanced buyer and seller experience tailored to customer needs. Additionally, we sought to experiment and develop a monetization strategy that leverages the car dealers already using the service.

I built a hand coded jQuery prototype that we used to evaluate ideas and interactions as well as get feedback from users. It includes the search and filtering experience, the car details page, the listing upload flow, and more. Try it out for yourself!

Buyers care about price, reliability, and condition. Functional needs such as a second car for their spouse/child or a replacement for their broken car were more common than aesthetic preferences.

Private sellers are motivated by getting as much value for their car as possible as well as selling quickly to alleviate vehicle storage.

Dealers want foot traffic to their car lots and to receive the best ROI when marketing their vehicles across services.

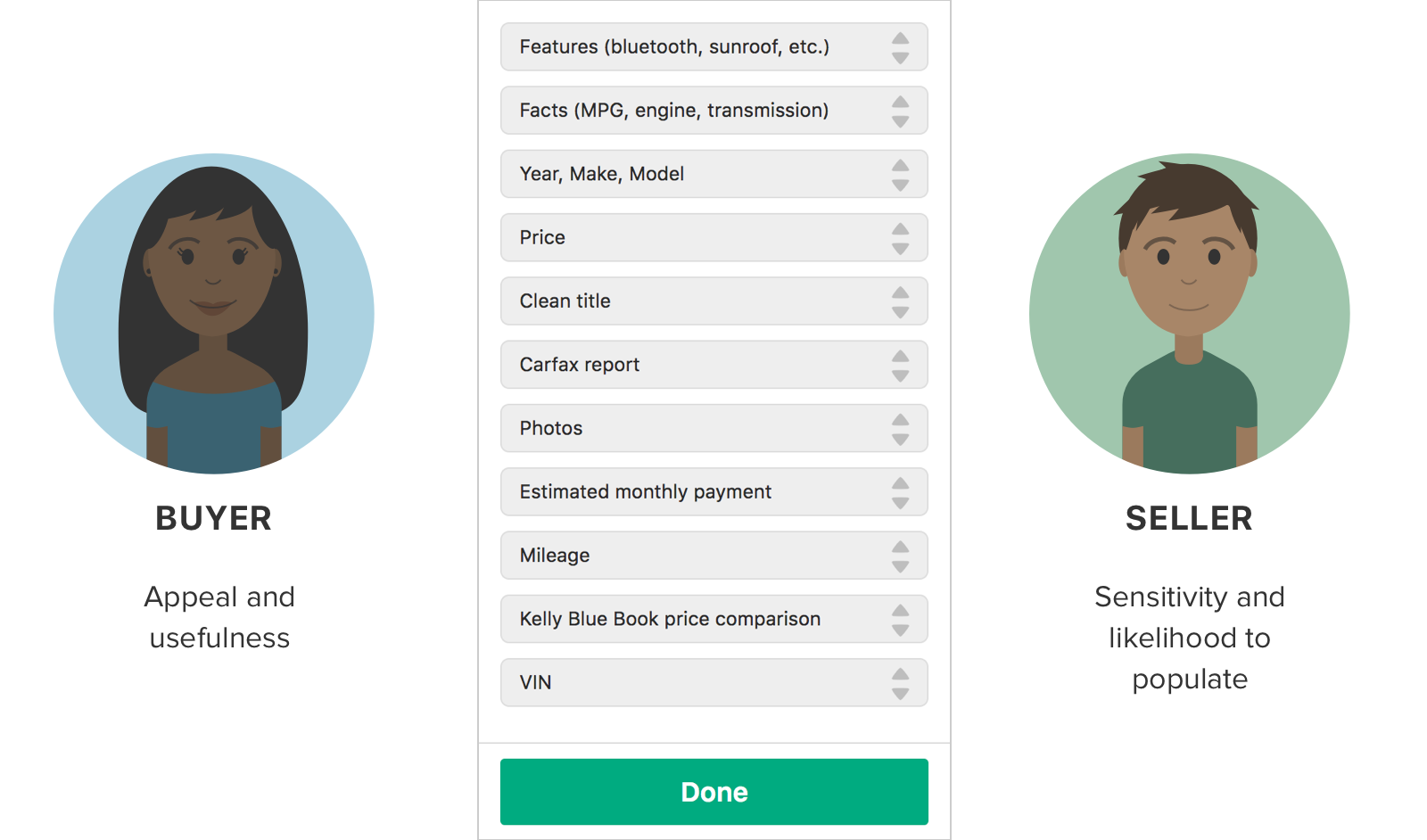

We learned that sellers are eager to provide information when prompted that will help sell a car faster. Buyers appreciated having a feature rich search to narrow to the best car for them and to have car listings be as in-depth and detailed as possible.

We also conducted a stack ranking exercise with buyers and sellers that included different autos data attributes. This would help us prioritize what search filters to develop as well as what information is displayed on listings.

Our initial hypothesis was that using a VIN or license plate number would provide a detailed data set for the car without much effort from the seller. However, in interviews sellers were apprehensive about providing it for perceived privacy issues.

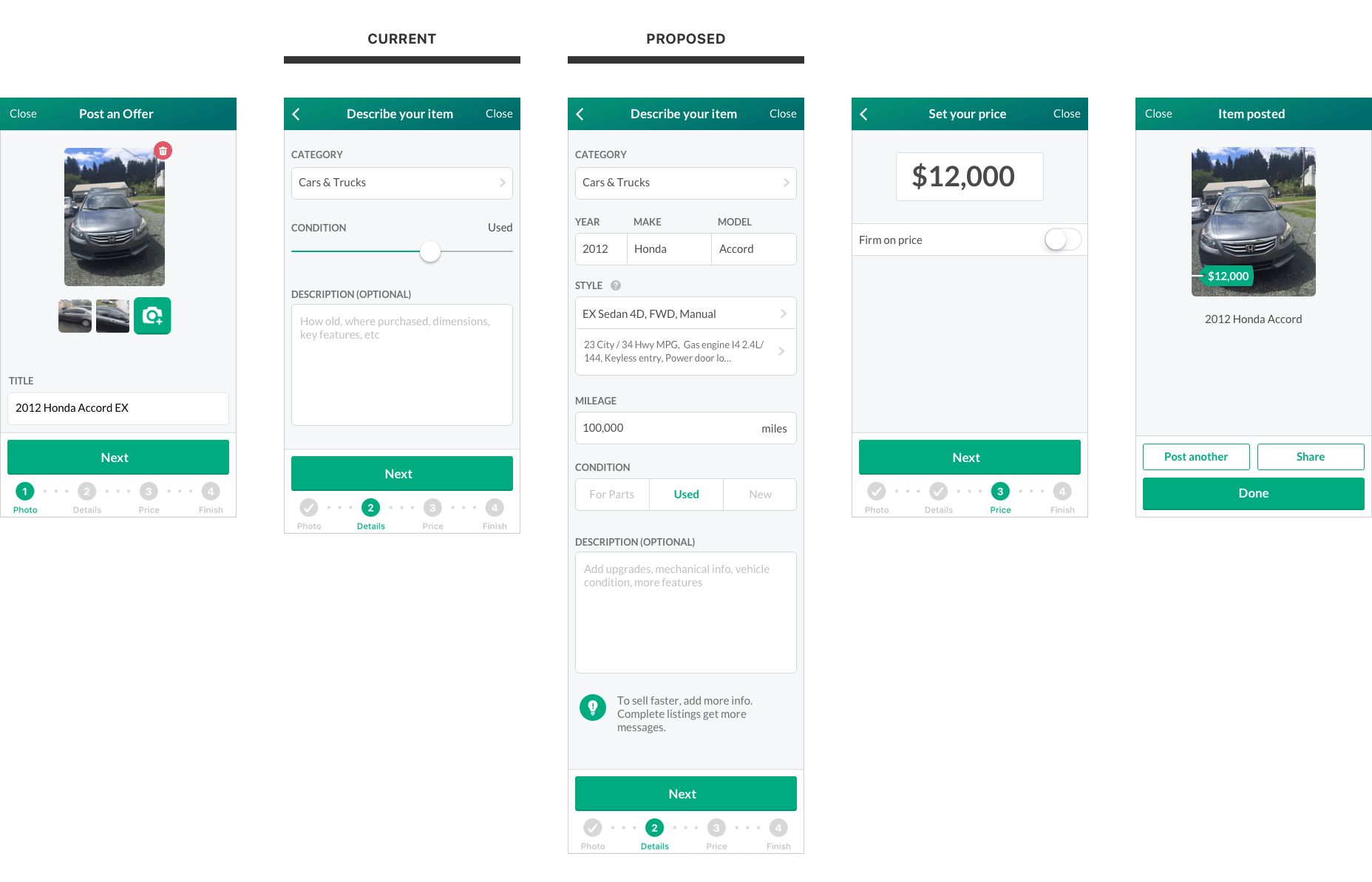

We then explored adding manual inputs to the Item Upload flow. Because adding additional fields to the flow could impact completion, we mitigated this this risk by making most fields beyond Year, Make, and Model optional. During usability, most sellers commented that they expected to see the additional fields and liked that it prompted them for data they may not have entered otherwise in the description. After launching this feature, we saw strong entry rates with negligible impact to completion rates.

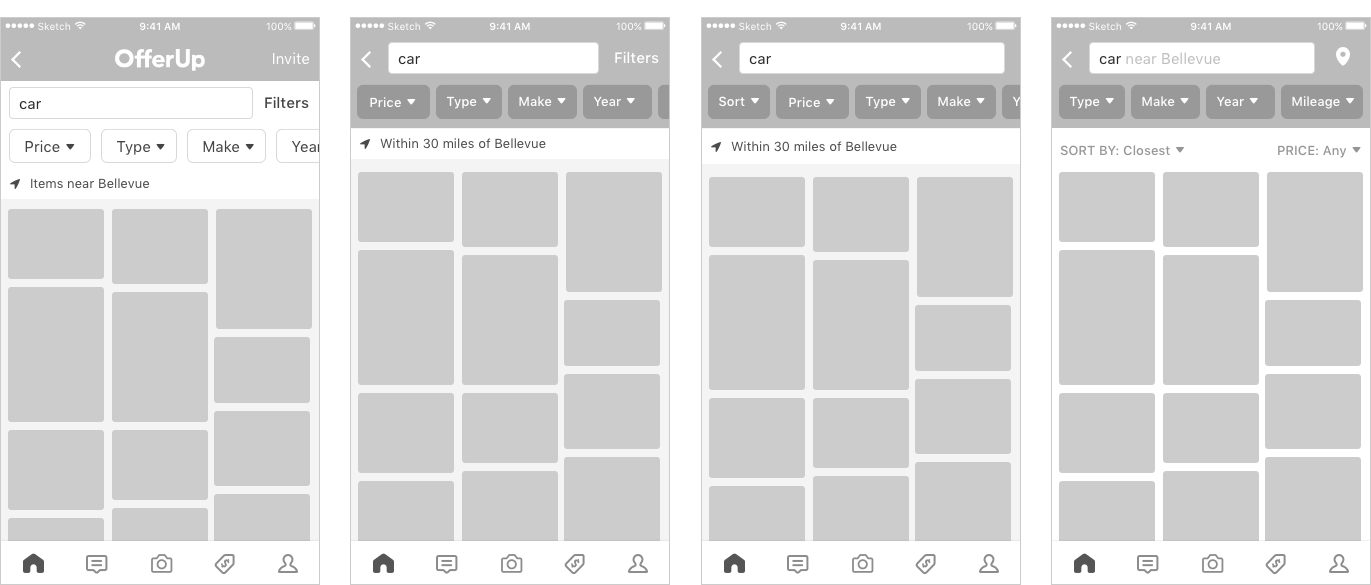

We intended to test two versions: one using the existing filter interaction and one with an exposed filter treatment. I drafted some low fidelity explorations that surfaced autos filters, provided easier access to common tools like sort and price, as well as revisited the organization of existing elements. The “Invite” action got very little engagement and customers annecdotally told us they were much more likely to introduce OfferUp to friends through word of mouth. This increased our confidence to deprioritize it on focused search pages.

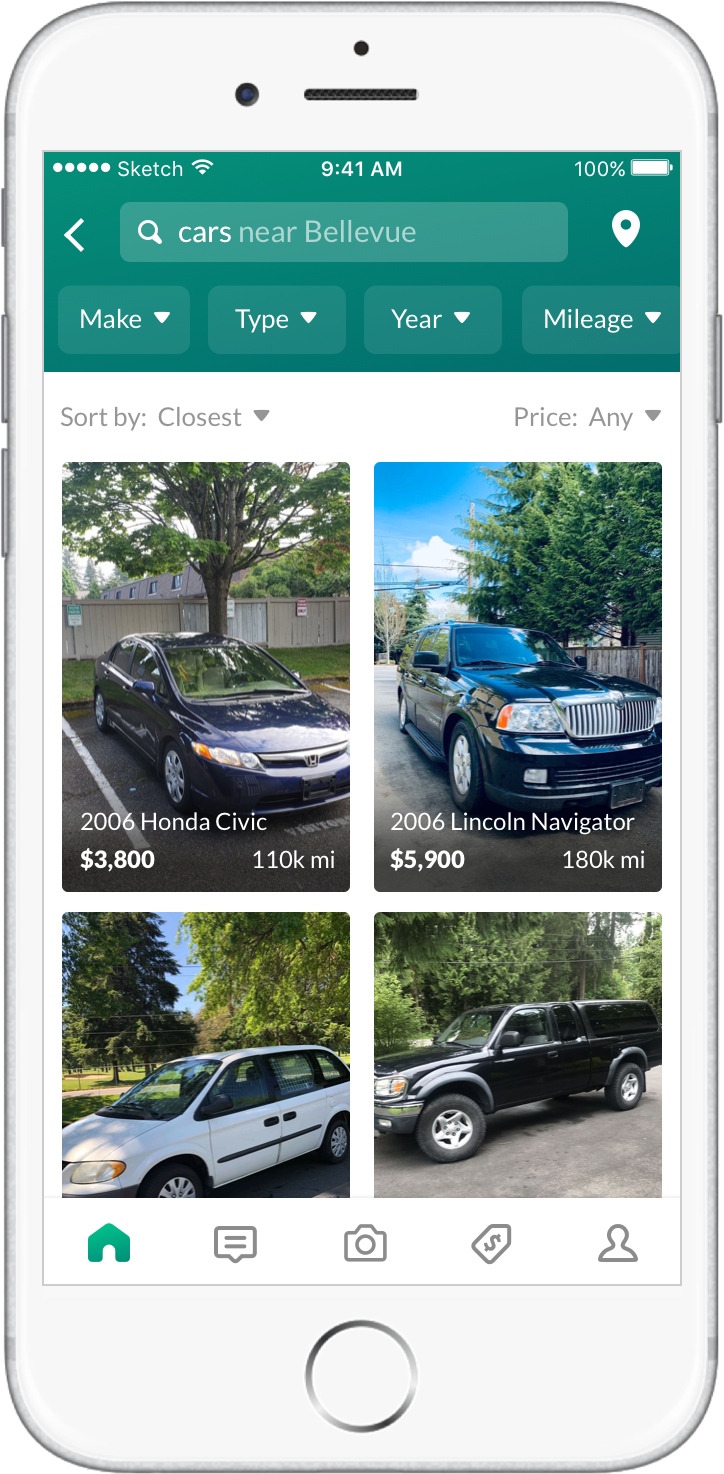

During usability testing, buyers immediately recognized the autos filters and appreciated the results updating instantly after applying them. When asked to update their location radius, customers confidently tapped on the map marker icon.

The new 2-column layout increases the photo size. During my explorations, I discovered that setting the tiles to a consistent height helps improve scannability and visual uniformity.

Buyers mentioned during usability sessions that having the vehicle data displayed on the search page is useful and helps them decide which listings to investigate further. However, due to engineering complexity, we weren't able to release this filter as it would have required a rebuild of our layout technology. Given customer interest, we kept the feature on our roadmap for a future release.

Using surveys, interviews, and dealership visits, we prioritized tools and features that help dealers sell. The subscription program included Verified Dealer branding to increase customer trust, special dealership profile pages, promoted results in search, and a dashboard to view the performance of their listings.

Dealer listings also included unlimited photos, click-to-call functionality for quick access to invested leads, and "estimated payment" information to help support dealers' financing businesses.

On the consumer side, we observed strong filter engagement, higher contact volume, and increased listing views in the Autos category. Additionally, we tracked improvements in customer satisfaction in our monthly survey.